Innovations to overcome barriers to access to finance for smallholders, SMEs and women

On September 14-18 and 21-25, 2020 the CGIAR Research Program on Forests, Trees and Agroforestry (FTA) held Forest, trees and agroforestry science for transformational change, a 10-day online event. The decadal event exclusive to the FTA community, gathered over 600 registered participants: researchers involved in FTA from its 7 managing partners (The Alliance of Bioversity and CIAT, CATIE, CIFOR, CIRAD, World Agroforestry, INBAR, and Tropenbos International), as well as invited keynotes from external organizations. The conference showcased 179 abstracts (60% of which is in collaboration with FTA’s external partners), 14 keynote presentations, 54 live presentations, 62 asynchronous presentations, and 40 technical posters.

The FTA researchers from all over the world convened online to present the most exciting research results in the programme, exchange experiences and lessons learned, and reflect on the way forward for transformative change in the fields of forestry and agroforestry science.

All the material from the conference can be found on the dedicated portal

As a follow up from the FTA 2020 Science Conference, FTA and its managing partners are now releasing knowledge products, extracting the highlights from the conference and bringing them to the public. The aim is to inform and support concrete action on the ground, focusing on transformative science derived from FTA’s most innovative research lines.

From Science to Action!

One of the first products deriving from the FTA 2020 Science Conference is the new webinar series “From Science to Action”. Open to the public, these events offer a way to showcase the best outcomes from the research discussed and presented in the various themes of the conference, bring together perspectives from different stakeholders and donors, and gather feedback from the audience. Most importantly, these webinars are also an occasion to present concrete actions that derive from FTA’s research: tools, publications, results that can be used by a wide variety of stakeholders in their activities. On the 26th of November 2020 the webinar series proudly opened its season with a first one on “Innovations to overcome barriers to access to finance for smallholders, Small and Medium Enterprises (SMEs), and women”, developed in coordination with Tropenbos International, who leads the FTA Priority 17 on Innovating finance for sustainable landscapes. The event can be replayed fully at this link.

Innovations to overcome barriers to access to finance for smallholders, SMEs and women

Over the years, the landscape approach has gained momentum and popularity in advancing interdisciplinary and holistic environmental management interventions. It has taken the center spot in discussions in international workshops, academic circles, and scientific debates as the go-to integrated approach in working towards sustainable use of forests, land, and other natural resources.

Much has been said about the landscape approach’s merits, but scaling up its implementation is lagging. One of the reasons is the lack of access to finance. To address this, FTA works with Tropenbos International (TBI) on innovative finance for sustainable landscapes, focusing on ways to overcome existing barriers for smallholders, SMEs, and women, important landscape actors that are often missed in existing landscape investments. Bringing finance to vulnerable groups and understanding the flows of finance to and from a landscape is crucial to fully realize the sustainability of landscapes.

Michael Allen Brady, FTA’s flagship leader for sustainable value chains and investments, moderated the first webinar, which convened a mix of researchers, financial experts, and government representatives, and attracted around 200 participants, to tackle innovative financial schemes for sustainable land uses with smallholder involvement. The webinar was highly successful and it included 2 polls for further interaction and a lively debate through a Q&A panel chatbox. A number questions from the audience unfortunately went unanswered and thus the panel took on board them after the event and can be read in this document.

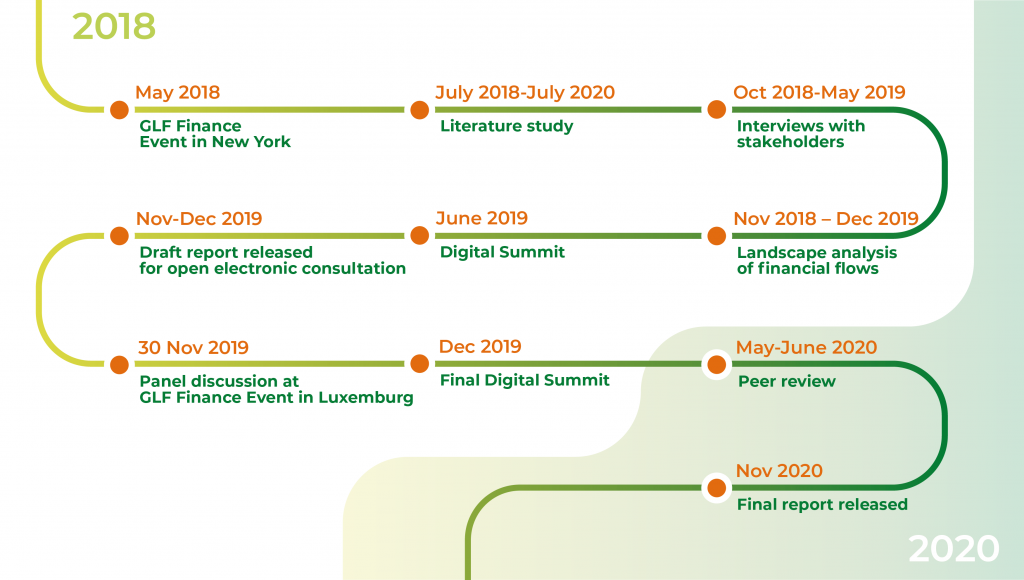

A product of an intensive 2-and-a-half-year consultative process, the latest report on ‘Innovative Finance for Sustainable Landscapes’ was launched at the webinar. The lead author of the report, Bas Louman of Tropenbos International (TBI), discussed common barriers that hinder large scale implementation of finance initiatives to transform landscapes. “Funds flow towards landscapes, but, in reality, only a small proportion reaches the field, and even less of that reaches communities and local farmers in small- and medium-sized farms,” Louman said. “We need to learn how to use finance better to transform and upscale our practices to become more sustainable,” he added.

- Blended finance – the strategic use of public or philanthropic development capital to mobilize additional external private commercial finance and can support SDG-related investment (pg. 19);

- Green bonds – form of debt that links the generated funds to climate goals or environmentally friendly investments (pg. viii); and

- Crowdfunding – pooling of small amounts of capital from a potentially large number of interested funders (pg. 44).

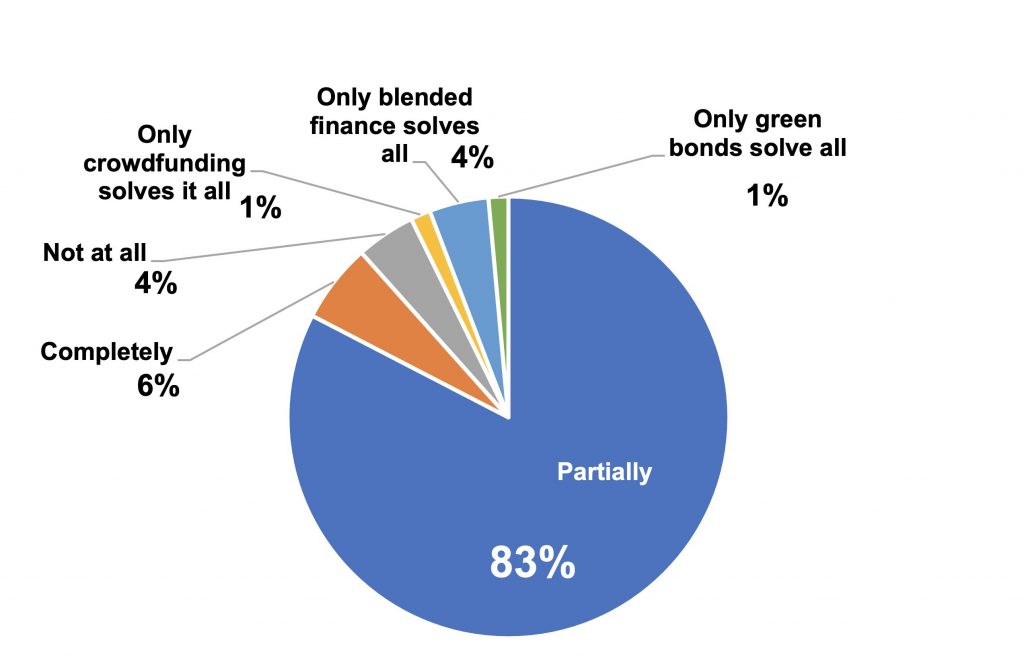

These innovative financial structures have potential to increase landscapes investments. However, challenges remain for smallholders for tapping into these financial sources. As manifested by the audience reaction to the first poll, more than 80% of them stated that these financial instruments alone are not sufficient or will only partially help overcome the current barriers. The equation is more complex.

Before initiating the discussions, the audience was treated to a poll for the following question: To what extent do you think that the discussed innovative finance structures (green bonds, blended finance, crowd funding) address the barriers for local farm and forest producer organizations to access finance? These were the results:

Risk – both on the investors and investees side – is clearly one of the greater barriers in allowing financial flows in landscape management. How big are these risks, who should bare them, and as Felix Hoogveld of the Ministry of Foreign Affairs of The Netherlands asked: “If you blend public and private finance, how do you share the risks? How do you come to a reasonable and fair balance of risks?” “It is a negotiation,” Louman said. “Together, different actors should have a mutual understanding of each other’s business, what are reasonable business risks, what are additional risks due to entering into a relatively unknown business, and how much risks is each party willing to take,” he replied.

Another obstacle for smallholder groups is the literacy of farmers and SMEs about these financial instruments. “(It is a) challenge for a lot of investors and banks to finance farmer producer groups who do not have a credit history or are too risky for a traditional credit perspective,” said Ivo Mulder, head of the Climate Finance Unit of UN Environment Programme. There is a need to support farmers in strengthening their financial literacy in order to improve their presentation of business cases to financial institutions.

Financial regulations and capital requirements are also barring smallholders. “The longer-term investment loans, which all tie to sustainable landscapes, are extremely unattractive for financial institutions to look at,” Eelko Bronkhorst of Financial Access commented. “Simply because they are multi-year and therefore the capital allocation is risky,” he added.

Currently, there are pilot initiatives on innovative risk strategies such as the interventions illustrated in the report of Guatemala’s Association of Forest Communities of Petén (ACOFOP) and the forest company Komaza in Kenya, which both yielded positive results. But more need to be documented and promoted.

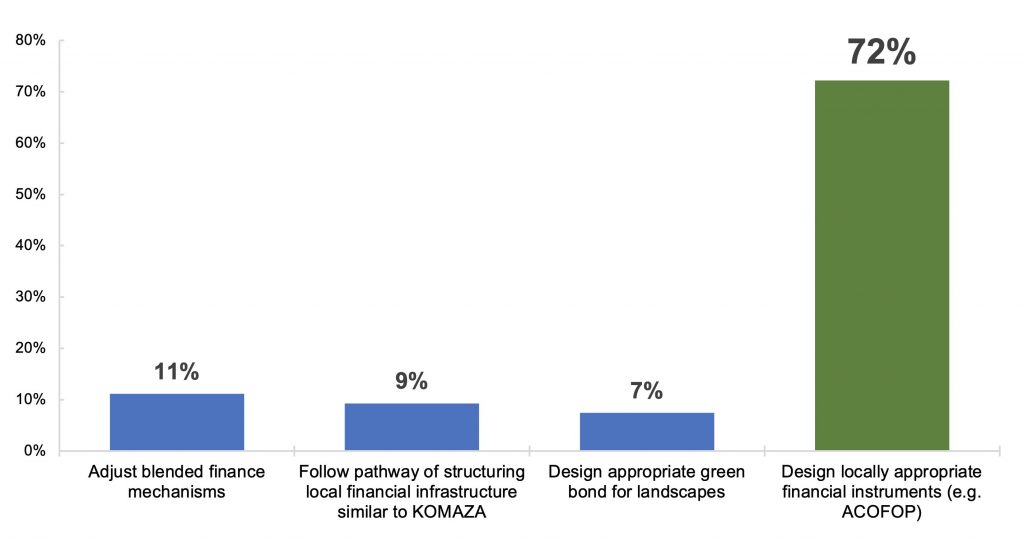

A second poll was then conducted to understand the audience’s point of view on the important steps for effective sustainable landscapes.

Designing a mechanism of blended finance, which incentivizes behavior change, and looks at the gender lens to modify investors’ perceptions and assessing opportunities, has been at the center of Impact Investment Exchange (IIX) work. “Instead of regarding women as a risky investment, we are actually able to show that their involvement in economic activities invested in mitigates risks. And we do this through data,” Chien said. By changing investors and companies’ perspectives and practices, IIX can tap financial opportunities and make them more inclusive to smallholders. “We connect the back streets to the wall streets,” Chien added.

Developing diverse investment portfolios with different levels of risk was also suggested. “(Usually) we look at only one crop, such as oil palm, rubber, rather than investing in a series of crops in the same area,” Louman suggested. “(Considering multiple crops) could spread the risks of investments and different asset forms.”

Presenting agroforestry as a ‘business’ case is reflective of this diverse portfolio. But for this to be successful, other mechanisms should be looked into, such as payment for ecosystem services (PES). “When you combine agriculture with planting trees, then actually those farmers are also producing public goods. When there is no PES, it would be even harder to achieve a kind of rate of return.”, said Busink.

The crucial role of governments in facilitating finance for sustainable landscapes was also highlighted in the conversation. “One thing the governments could think of is to ask for a percentage of the capital be directed to farmer producer groups,” Mulder said. Governments are integral in addressing fundamental issues in the landscapes, such as tenure insecurity, which implicates financing. “What is the long-term prospect for them (the farmers) to make investments, if you’re not sure that the land is yours after five years,” Busink said.

“Speaking the same language” is one of the recommendations. “So much gets lost in translation,” Bronkhorst said. “If we can find a way to translate our work into a simple business case to start… that could be a very practical approach,” he added. Collaborations with existing institutions that could act as intermediaries are seen to fill this gap. Farmers and SMEs should be put in a position to understand precisely what investors have to offer, with all the implications, while financers should take into consideration the culture, expectations, needs and methods of their future investees.

The momentum and the drive to unlock capital and investments for sustainable landscapes are getting stronger. With a new GEF project – Green Finance for Sustainable Landscapes, Mulder presented an opportunity to tap private capital from banks and financial institutions. “The finance case is (still) weak” Mulder said. “But we aim to increase financial, time-bound commitments,” he added.

In 2021, FTA will be bringing its technical expertise into consolidating its partnerships with UNEP, IIX and Financial Access, amongst other institutions, to accelerate the financing of landscape initiatives for sustainability. “We have an issue of urgency here,” Vincent Gitz, Director of FTA, underlined. “There is plenty of money for investments. Now is an opportunity to find how that could reach the bottom of the pyramid”, he said.

FTA and Tropenbos’ newly launched report Innovative finance for sustainable landscapes “is a wonderful way to set the stage for future collaborations,” Chien concluded.